The Facts About Summitpath Llp Revealed

Wiki Article

An Unbiased View of Summitpath Llp

Table of ContentsThe Best Strategy To Use For Summitpath LlpThe Summitpath Llp IdeasSummitpath Llp Fundamentals ExplainedThe 8-Minute Rule for Summitpath LlpFascination About Summitpath Llp

A monitoring accountant is a vital function within a company, but what is the function and what are they anticipated to do in it? Functioning in the accountancy or money department, monitoring accountants are responsible for the preparation of management accounts and a number of other records whilst additionally managing general audit procedures and techniques within the company - bookkeeping service providers.Compiling methods that will minimize business expenses. Getting finance for jobs. Suggesting on the economic implications of organization decisions. Creating and supervising economic systems and procedures and recognizing opportunities to enhance these. Managing income and expense within business and making sure that expense is inline with budgets. Supervising audit specialists and assistance with common accountancy tasks.

Analysing and handling danger within business. Administration accountants play a highly essential role within an organisation. Key economic information and records generated by monitoring accounting professionals are made use of by elderly monitoring to make enlightened organization choices. The evaluation of service efficiency is a crucial function in an administration accountant's job, this analysis is produced by taking a look at current financial details and additionally non - economic information to figure out the setting of the company.

Any organization organisation with a monetary division will call for an administration accountant, they are additionally frequently used by banks. With experience, a management accounting professional can expect strong profession development. Experts with the required certifications and experience can go on to end up being economic controllers, financing supervisors or chief economic officers.

The Ultimate Guide To Summitpath Llp

Can see, evaluate and recommend on alternating sources of service financing and different methods of elevating financing. Communicates and encourages what impact financial decision making is having on developments in regulation, ethics and governance. Assesses and advises on the right strategies to take care of business and organisational efficiency in connection with business and money threat while interacting the effect successfully.

Uses numerous innovative approaches to execute approach and handle adjustment - Calgary CPA firm. The distinction in between both financial accountancy and managerial accountancy problems the intended individuals of details. Supervisory accounting professionals need organization acumen and their goal is to act as organization partners, assisting magnate to make better-informed decisions, while monetary accounting professionals aim to generate economic files to supply to outside events

Little Known Questions About Summitpath Llp.

An understanding of service is likewise vital for management accountants, along with the ability to communicate successfully in all degrees to suggest and communicate with elderly participants of personnel. The tasks of an administration accounting professional should be carried out with a high level of organisational and calculated thinking skills. The typical salary for a legal monitoring accounting professional in the UK is 51,229, a boost from a 40,000 ordinary made by administration accountants without a chartership.Providing mentorship and management to junior accountants, promoting a culture of partnership, development, and functional quality. Collaborating with cross-functional groups to establish spending plans, forecasts, and lasting monetary techniques. Staying informed concerning modifications in accounting laws and finest methods, applying updates to inner processes and documents. Must-have: Bachelor's level in accountancy, financing, or a relevant field (master's preferred). Certified public accountant or CMA accreditation.

Flexible work options, consisting of hybrid and remote schedules. To use, please send your return to and a cover letter outlining your credentials and passion in the elderly accountant role (https://www.intensedebate.com/profiles/summitp4th).

Summitpath Llp Can Be Fun For Anyone

We aspire to discover a competent elderly accountant prepared to add to our company's monetary success. For questions regarding this position or the application process, call [HR get in touch with details] This work posting will end on [day] Craft each area of your job summary to reflect your organization's distinct requirements, whether working with an elderly accountant, corporate accountant, or another specialist.

:max_bytes(150000):strip_icc()/accountant.asp-FINAL-1-1-e83d0f7de3b848ada757ac5b9af16b72.png)

A strong accountant task account surpasses noting dutiesit clearly connects the credentials and assumptions that align with your company's requirements. Set apart in between necessary credentials and nice-to-have skills to aid candidates assess their suitability for the placement. Define any qualifications that are required, such as a CERTIFIED PUBLIC ACCOUNTANT (Cpa) permit or CMA (Licensed Monitoring Accounting professional) classification.

Unknown Facts About Summitpath Llp

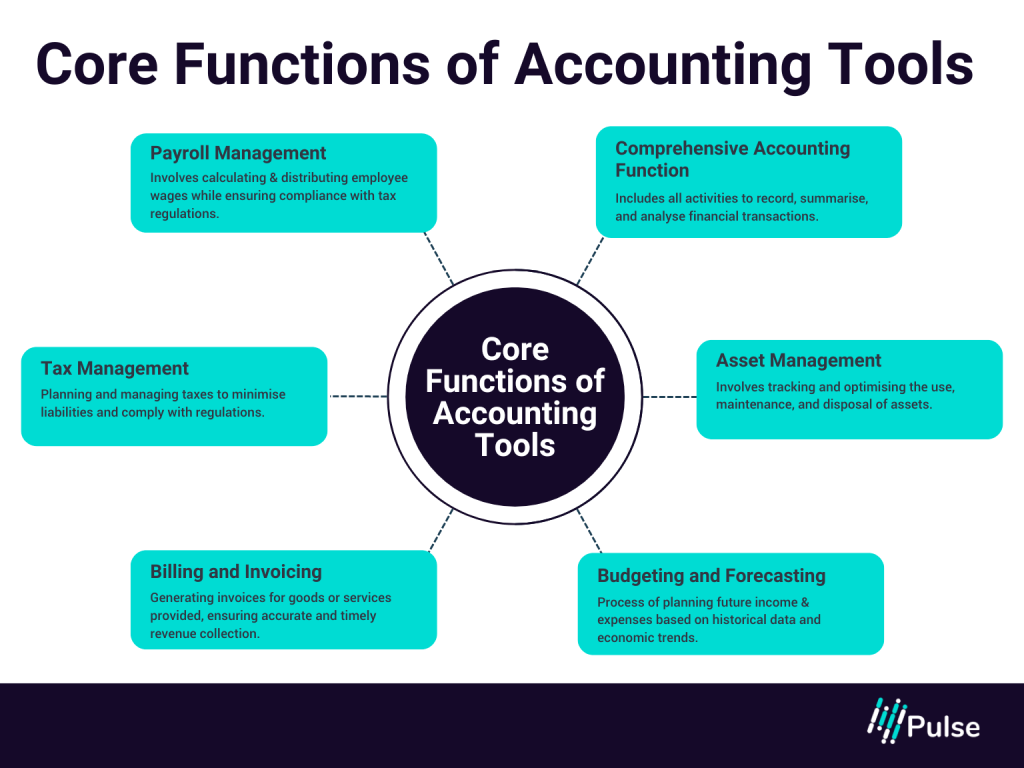

Follow these best practices to develop a task description that resonates with the ideal prospects and highlights the distinct facets of the function. Audit duties can differ commonly depending on seniority and expertise. Prevent obscurity by outlining particular tasks and areas of focus. For instance, "prepare regular monthly monetary statements and look after tax obligation filings" is far clearer than "take care of monetary records."Reference essential locations, such as monetary reporting, bookkeeping, or pay-roll administration, to attract prospects whose skills match your demands.Utilize this accountant work description to create dig this a job-winning resume. Accountants aid organizations make critical monetary choices and modifications. They do this in a variety of methods, consisting of research, audits, and data input, reporting, evaluation, and monitoring. Accountants can be liable for tax reporting and filing, resolving annual report, aiding with department and business budget plans, financial forecasting, interacting searchings for with stakeholders, and more.

Report this wiki page